This Simple Idea Will Make You Rich

I binge-watched multiple YouTube business gurus.

But none of their advice seemed to work.

Every video I watched seemed to raise more questions than it answered.

This was incredibly frustrating.

It felt like they were deliberately not telling me something.

This changed when I encountered The Almanack Of Naval Ravikant.

You can think of Naval as the business Buddha.

He’s a deca millionaire entrepreneur and investor and in this book, he explained a simple timeless system that everyone can use to get rich without getting lucky.

Understanding Wealth

Money is how we transfer wealth.

It’s the credits you get for providing value to society.

You did something good in the past so society rewards you with credits you can use in the future.

You won't get rich by renting out your time.

No matter how much you make per hour, your income is still capped because you have a limited amount of time.

It's important to realize the following:

You don’t want money, but you want the feeling that you think money will give you, which is freedom.

So in order to get this, you need to find a way to disconnect your time from your income.

You do this by earning with your mind, not your time.

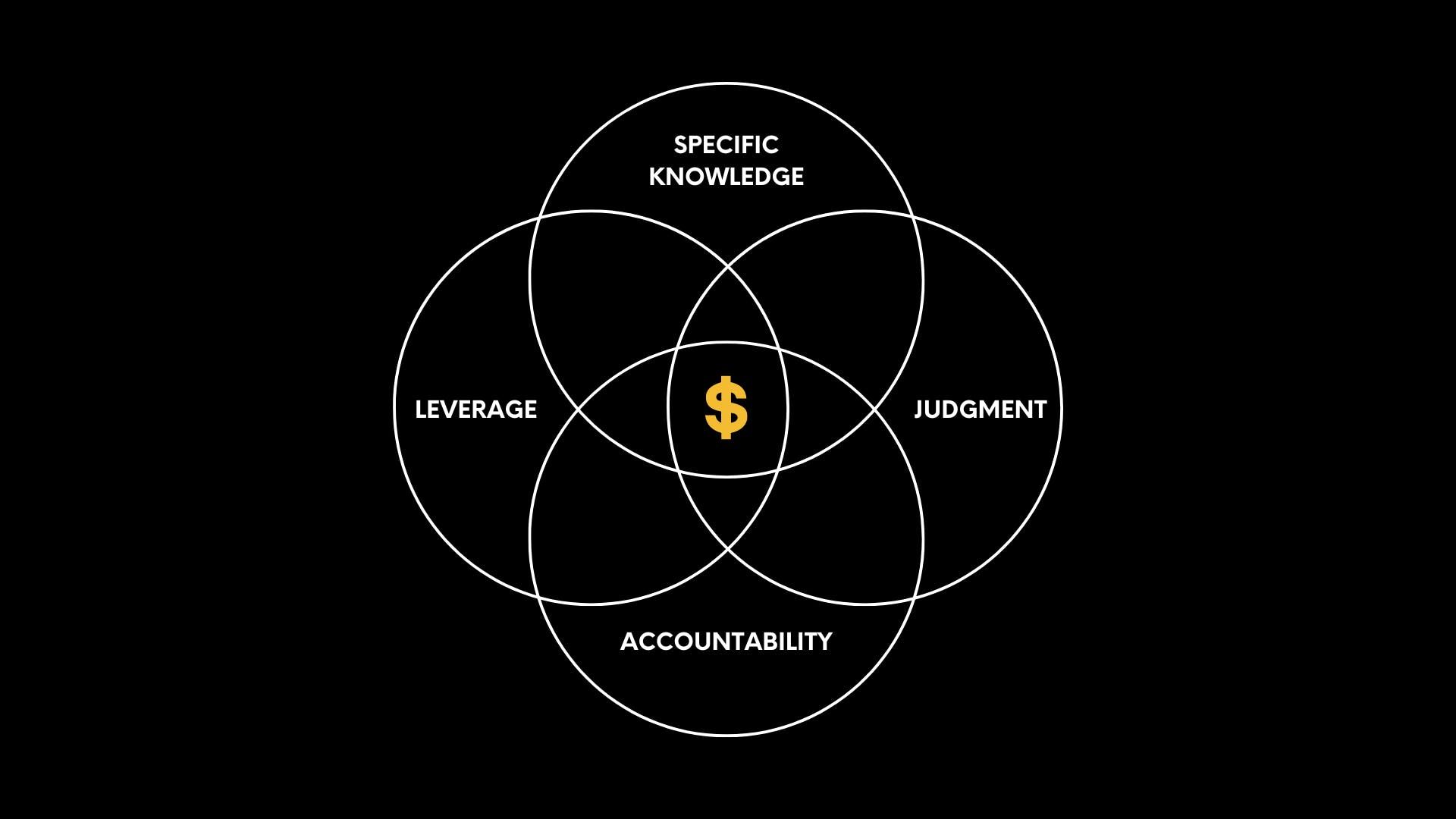

And this is where the 4-part framework comes into play.

If you get all 4 of these things you can get complete freedom and control over your time.

1. Specific Knowledge

I’ll use legendary investor Warren Buffett to illustrate the points.

When he was young he admired Benjamin Graham, the author of the book The Intelligent Investor.

When Buffett graduated, he wanted to learn from Graham, so he offered to work for free.

Graham’s response was ‘you’re overpriced’.

Both Buffett and Graham understood the value of an internship.

Buffett may not have gotten any money, but he would’ve gotten something much more valuable: specific knowledge.

This is knowledge that you can’t be trained for, but it can be learned.

It is at the edge of knowledge and it’s found through observation and experience.

It’s something that’s valued highly in society, but society doesn’t yet know how to get it.

In the case of Buffett, it were things like the investing strategies and decision-making process of Graham.

Buffett observed this and through this process he internalized it.

This specific knowledge is the thing that will make you rich once you’re able to sell it on scale.

This is where the second point comes in.

2. Leverage

If I would ask you to open this door with one finger, where would you push?

Would you push here or here?

Unless you have enormous fingers, you would push at #2.

The reason for this is that it gives you leverage. And this is also how it works for making money.

You want to position yourself in places where your inputs don’t equal your outputs.

This is how you disconnect your time from your income.

You want to find things that are scalable and available for everyone.

Money and employees give you leverage, but this won’t be available to you at the start.

Ideally, you want to aim for things that have zero marginal costs of production for new units. Examples of this are content and code.

The more leverage you have the more output you’ll get from the same input.

Leverage takes time to build, but it will allow you to sell on scale once you’ve built it.

This is why personal brands are so powerful. You create a group of followers that are interested in the things you’re interested in and this allows you to make a career out of being yourself and exploring your interests.

3. Accountability

You will be rewarded in direct proportion to the accountability you take.

The more accountability you take, the more you will be rewarded.

By taking accountability you get rewarded for your efforts - or you take losses.

But as long as you’re honest and make a high-integrity effort, you will be fine.

We all fail so it’s not about avoiding failure but about learning from it so we can grow and try again.

So take on accountability for the things that interest you and help people for free. You’ll help others and build yourself up at the same time, which is a massive win-win.

4. Judgment

That brings us to the 4th part of the puzzle.

If you would get 1 million dollars to invest, would you give it to me or Warren Buffett?

I appreciate you if you would give it to me, but if you would be smart you would give it to Warren Buffett.

The reason for this is because he has better judgment when it comes to investing money.

Judgment is an amplifier of everything we talked about so far.

It’s about making good decisions, which is a result of direct experience, reflection, and thinking clearly.

You need to be able to control your emotions and look rationally at the situation. Think about the long-term effects of your decisions and then act accordingly.

In an age of nearly unlimited leverage, judgment becomes the most important skill.

It amplifies every decision you make and this compounds over time.

So in short, this model shows you how to productize yourself.

- “Productize” and “yourself.”

- “Productize” has leverage.

- “Yourself ” has judgment and accountability.

- Both have specific knowledge.

Control your time and earn with your mind by productizing yourself.

That's it for this letter.

If you want my systems and strategies to level up faster, check out The X Growth System.

Have a great day!

(Ein)Stijn

Join 6,000+ Digital Writers!

Receive weekly emails to grow and monetize your digital writer business via Twitter (𝕏) to get time and location freedom.